University of Minnesota Extension Releases Sales Tax Study to Estimate Sales Tax Paid Annually by Residents and Non-Residents

University of Minnesota Extension recently conducted a study to estimate the proportion of sales tax proceeds attributed to both Marshall residents and non-residents.

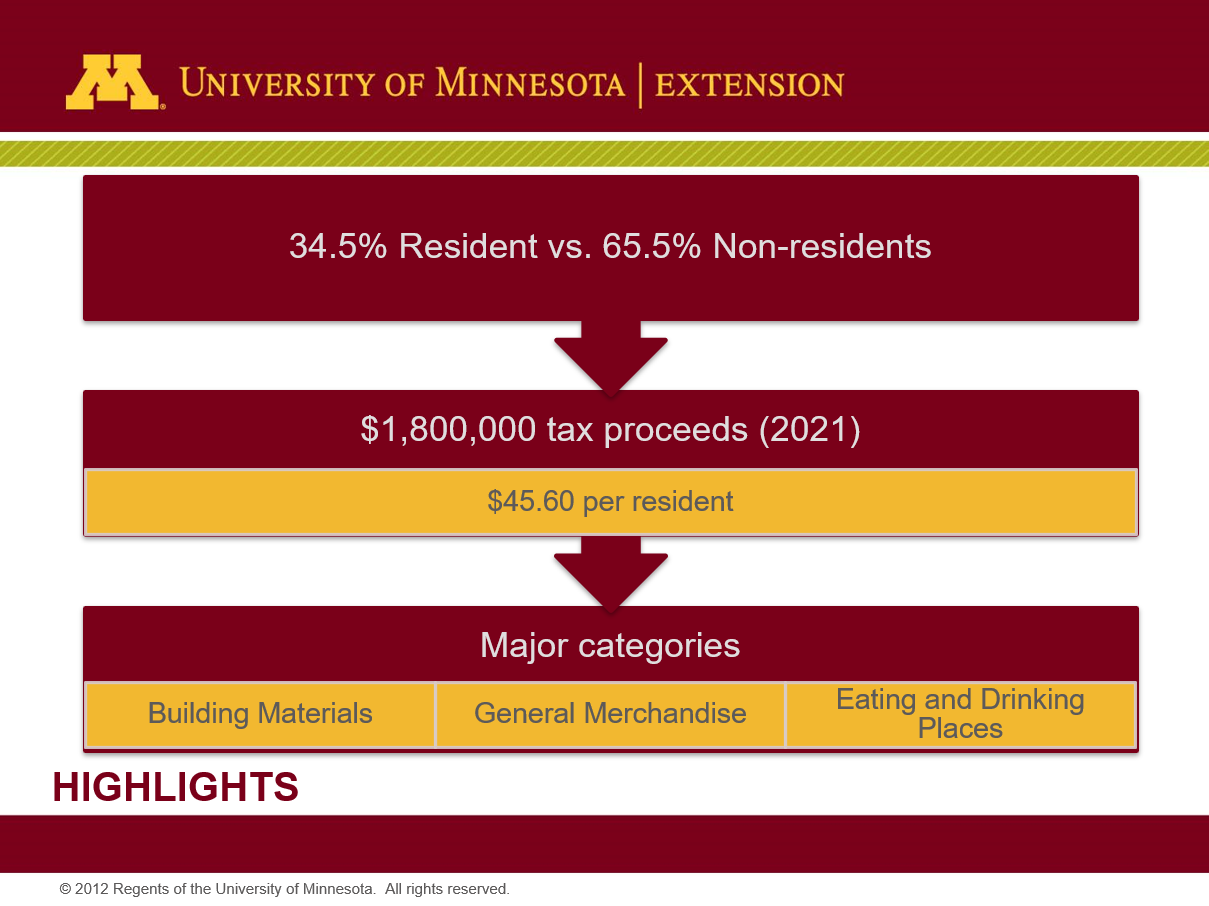

Using 2021 sales and use tax data available from the Minnesota Department of Revenue, Extension estimated that non-residents account for 65.5 percent of taxable sales subject to a local option sales tax, while residents account for 34.5%.

In a scenario where $1,800,000 of local option sales tax was collected in a given year, Marshall residents would have contributed $621,000 in taxes and non-residents would have contributed $1,179,000. Based on that allocation, each Marshall resident would have paid, on average, an additional $45.60 in sales tax for that year.

While non-residents are estimated to contribute more annually to sales tax collection than residents, the City of Marshall is responsible for maintenance and capital improvements over the life of any project funded initially by a sales tax.

Marshall’s economy helped frame the analysis for the different merchandise categories:

- Residents of nearby communities can easily access Marshall businesses. For this analysis, cross-hauling has the net effect of increasing non-resident spending as Marshall is a central shopping hub in the region.

- Marshall has more workers entering the city for employment than residents who leave for work. In this dynamic, commuters often shop for goods and services near where they work and those commuting into the city purchase in the city.

Policymakers must determine the best allowable method to raise revenue from a variety of options. One option is raising property taxes, which is not directly related to a household’s current income and raises the financial burden of low-income or retired homeowners. Sales taxes raise revenues based on household expenditures, which, in Minnesota, excludes the basic necessities of food and clothing.

The City is proposing to construct an aquatic center with funds from an extension of the current sales tax. Absentee voting began Friday, September 22nd on whether to extend sales tax to fund the City of Marshall’s proposed aquatic center construction. The half cent sales tax equates to 50 cents for every $100 spent.

Mayor Bob Byrnes explained the rationale behind utilizing local option sales tax for funding of projects, “As a regional center, a major employment and goods and services hub, Marshall serves a large surrounding area. Funding projects with a local sales tax will more closely distribute the costs of the project to the users of the facilities as compared to a property tax increase.”

For more information please contact the City at 507-537-6760.